Clover Health is a Preferred Provider Organization and a Health Maintenance Organization with a Medicare contract. For plans that provide drug coverage, the formulary may change during the year. Out-of-network/non-contracted providers are under no obligation to treat Clover members, except in emergency situations. For a decision about whether we will cover an out-of-network service, we encourage you or your provider to ask us for a pre-service organization determination before you receive the service. Please call our customer service number or see your Evidence of Coverage for more information, including the cost-sharing that applies to out-of-network services.

You will find Medicare Advantage all-in-one healthcare plans, offering both medical and prescription drug coverage. Take advantage of our network of more than 35,000 providers and healthcare facilities, with extra benefits that cover more than Original Medicare alone. Optima Medicare plans include coverage for vision, dental, and hearing, as well as over-the-counter products and prescription drug coverage. Medicaid is a joint federal and state program that helps pay health care costs if you have limited income and resources and meet other requirements.

All states also have Medicaid programs for people with limited incomes and assets who need nursing home care, long-term care services, and home health care services. Some states also have programs for individual adults who don't fit any of these categories. Each state uses financial eligibility guidelines to determine whether you are eligible for Medicaid coverage. Generally, your income and assets must be below a certain amount to qualify, but this amount varies from state to state and from program to program.

You are eligible for Medicaid if you fall into an eligible group and meet that group's financial eligibility requirements. If you are eligible for Medicare and Medicaid , you can enroll in both. Medicaid can cover services that Medicare does not, like long-term care. Some states offer a Medicaid spend-down program or medically needy program for individuals with incomes over their state's eligibility requirements.

A spend-down program allows you to deduct your medical expenses from your income so that you can qualify for Medicaid. Banner Medicare Advantage offers the only plans in Arizona with quality health care, medical and prescription drug coverage all together in one plan. With Banner Medicare Advantage, you receive integrated care between your health care providers and insurer – all from Banner Health. EHealth's GoMedigap website is operated by eHealthInsurance Services, Inc., a licensed health insurance agency doing business as eHealth, for the solicitation of insurance. Contact may be made by an insurance agent/producer or insurance company.

GoMedigap, eHealth, and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. EHealth's Medicare website is operated by eHealthInsurance Services, Inc., a licensed health insurance agency doing business as eHealth. The purpose of this site is the solicitation of insurance. EHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. HealthPlanOne, is a licensed and certified representative of Medicare Advantage HMO, PPO and PFFS organizations and stand-alone prescription drug plans with a Medicare contract. ClearMatch™ Medicare is not affiliated with the federal government.

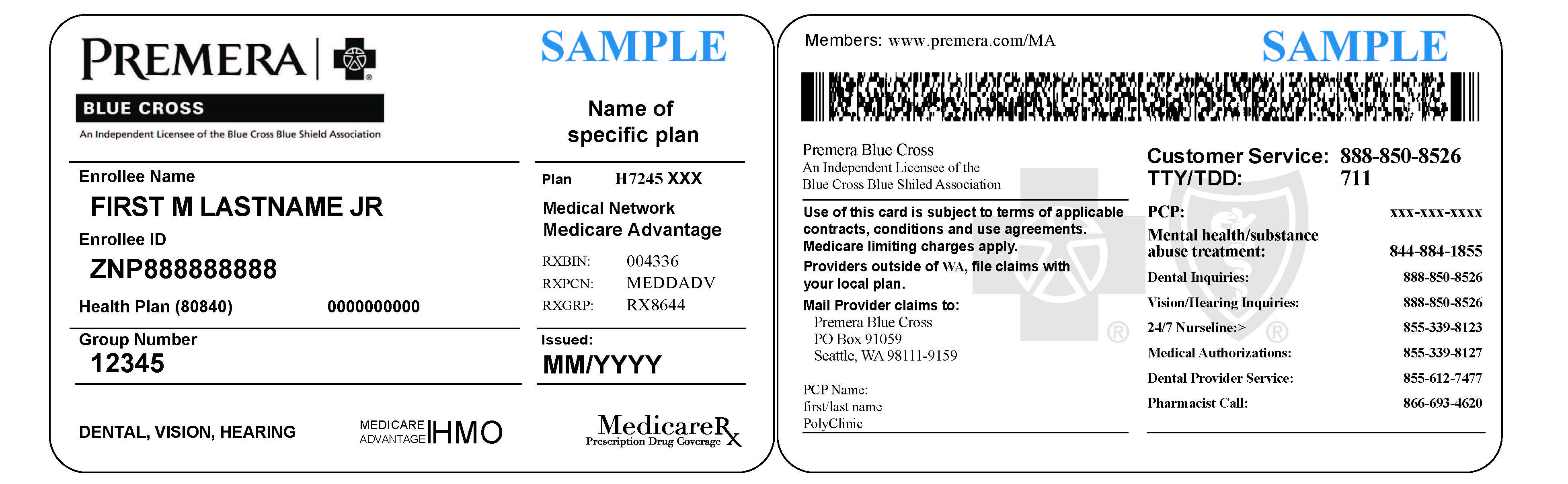

A member ID number and group number allow healthcare providers to verify your coverage and file insurance claims for health care services. It also helps UnitedHealthcare advocates answer questions about benefits and claims. Each health insurance policy will outline a few separate waiting periods. This is the time you must wait before making a non-accidental claim after purchasing the health insurance policy. The second is a waiting period for pre-existing diseases. Depending on whether you have a pre-existing illness or not, you'll want to weigh your options.

Some health issues such as hernia or ENT disorders will only be covered after a few years of cover. Generally, the waiting period for these issues is 2 years. Most health insurance policies will cover maternity expenses only after a few years. If you're planning on growing your family, you'll want to take this into consideration.

It may seem frivolous, but one great reason to get a health insurance policy is due to the health insurance tax benefits. Premiums that you pay to maintain a TATA AIG health insurance policy are exempt from taxes under Section 80D of the Income Tax Act. If you've bought a health insurance plan for yourself, your spouse or your kids, you can claim up to INR 25,000 per year. If you've bought a medical insurance plan for your parents who are over the age of 60, you can claim an additional deduction of INR 50,000 per year. #Please note tax benefits are subject to change in Income Tax laws.

Your member ID number and group number allow healthcare providers to verify your coverage and file claims for health care services. These numbers also help UnitedHealthcare advocates answer questions about your benefits and claims. Another important thing you need to check before you purchase or renew your medical insurance policy is the insurance provider's claim settlement ratio. The ratio will tell you how many claims they have settled out of the total number of claim requests they received. At TATA AIG, we're committed to keeping our promise of looking after you, your health and your finances.

In FY19-20, we settled 96.21% of the health insurance claims that came our way. Cashless claims with Tata AIG's health insurance policy is easy. We have tied up with over 7,200+ hospitals across India, so no matter where you are, you'll have a network hospital close by. In the unlikely possibility that you're unable to get to one of our network hospitals, you don't need to break a sweat.

You can go across to any trusted healthcare facility and get the treatment you need. The back of your member ID card includes contact information for providers and pharmacists to submit claims. It also includes the member website and health plan phone number, where you can check benefits, view claims, find a doctor, ask questions and more. Co-Payment If you'd like to lower your health insurance premium, you can opt for co-payment.

You can promise to pay a certain percentage of each claim you make against your medical insurance policy, and your insurance provider will take care of the rest. If you'd like your insurance provider to settle the full claim, you can opt-out of co-payment. Many treatments today can be completed within just a few hours. Our health insurance plans cover more than 540 daycare procedures. This means that you can make claims against covered daycare procedures even if you do not have to be hospitalised for more than 24 hours. We're sure you've spent hours looking for the perfect health insurance policy online.

If you've been visiting the doctor regularly over the years, you may have noticed that the costs of medical treatments and check-ups have gone up. The easiest way to keep up with inflated healthcare costs is by getting yourself a good medical insurance policy while you're still young and in the best of health. If you're looking for enhanced, all-rounded safety, TATA AIG MediCare Premier is the right option for you.

Along with all the cover offered by our MediCare plan, this health insurance policy also provides cover for high-end diagnostics, OPD dental treatment, emergency air ambulance and more! The sum insured amounts offered for TATA AIG MediCare Premier can be as low as INR 5 lakhs or as high as INR 50 lakhs. You'll get both quality health care and comprehensive insurance coverage in a single plan – including prescription drug coverage – making it easier for you to stay healthy. Optima Health is the trade name of Optima Health Plan, Optima Health Insurance Company, and Sentara Health Plans, Inc. Optima Health Maintenance Organization products, and Point-of-Service products, are issued and underwritten by Optima Health Plan. Optima Preferred Provider Organization products are issued and underwritten by Optima Health Insurance Company.

Sentara Health Plans, Inc. provides administrative services to group and individual health plans but does not underwrite benefits. All Optima Health plans have benefit exclusions and limitations and terms under which the policy may be continued in force or discontinued. State Health Insurance Assistance Programs are free volunteer-based Medicare counseling services available in each state. These programs provide unbiased counseling about Medicare questions – including details about coverage, benefits, and costs .

SHIPs can also assist beneficiaries with complaints or appeals. Importantly, SHIPs can also assist with coverage changes like choosing the right Medicare Advantage or Part D plan for your needs. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program. Care provider visits, transportation, home care, hospital visits, and even nursing home stays when necessary. If you have Medicaid, you won't have to pay a monthly premium for the long-term care portion of the PACE benefit.

If you have Medicare but not Medicaid, you'll be charged a monthly premium to cover the long-term care portion of the PACE benefit and a premium for Medicare Part D drugs. However, in PACE, there's never a deductible or copayment for any drug, service, or care approved by the PACE team of health care professionals. Detailed information regarding this program can be found at the NC PACE website.

If you have a private Medicare insurance plan, however, you may potentially have a group number related to your policy, depending on your plan. Create a HealthPartners account to get the most from your health insurance plan. You only need to know your member ID number and your birth date. Once you create an account, you can view your benefits, track your medical spending, compare the cost of medical procedures and find ways to lower the cost of care. This pocket-friendly policy offers you all the benefits you need to deal with medical emergencies that come your way. TATA AIG MediCare offers benefits such as global cover and cover for bariatric surgery as well!

Depending on your needs, you can select your sum insured. We offer amounts as low as INR 3 lakhs and as high as INR 20 lakhs under the TATA AIG Medicare health insurance plan. The representatives at Medicare can help you with claims and appeals issues if you have Original Medicare. Medicare Advantage plans, as well as Part D prescription drug plans, are offered by private insurance companies, not the U.S. government. This means that these plans will have their own insurance ID cards for you to use.

UPMC for Life Medicare Advisors host informative community and member meetings online and throughout our service area. You'll learn about Original Medicare, Medicare Advantage, and prescription drug coverage. Some health insurance policies have a cap on the maximum age an individual can be to enjoy cover. You should check whether you can enjoy life-long renewals under your medical insurance policy before making a decision. TATA AIG MediCare Protect is the ideal plan for those concerned about the costs attached with a stay at the hospital.

This health insurance policy covers pre- and post-hospitalisation expenses, allowing you to focus on getting better instead of stressing about hospital bills. Learning Center Learn how Medicare and Medicare Advantage plans work, which plan is right for you, and how soon you can enroll. Also, find answers to frequently asked questions.Ready to Enroll? Enroll during your Initial Enrollment Period, which is seven months long - including your 65th birthday month, the three months before and the three months after. You can enroll or switch plans during the Annual Election Period, October 15 through December 7.Already a Member?

Access more plan tools and detailed benefit information when you sign in to your secure portal. Make the most of your health plan by registering online or on the mobile app. Our quality, affordable health plans include $0 premium options and more coverage for virtual care. You can add drug coverage by enrolling in a private "stand-alone" drug plan for an additional premium.

You can buy separate Medigap insurance to cover some or most of the out-of-pocket costs of hospitals and doctors . This communication provides a general description of certain identified insurance or non-insurance benefits provided under one or more of our health benefit plans. Our health benefit plans have exclusions and limitations and terms under which the coverage may be continued in force or discontinued. For costs and complete details of the coverage, refer to the plan document or call or write Humana, or your Humana insurance agent or broker. In the event of any disagreement between this communication and the plan document, the plan document will control. Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract.

Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program Enrollment in any Humana plan depends on contract renewal. Get answers to your questions about Medicare, including how to apply, get a replacement card, and what is Part D for prescription drugs. Also, learn about Medicare coverage when you live abroad. Some health insurance plans include special savings accounts for health-related expenses.

The key to getting the most out of your savings account is knowing which type you have and how to use it. Check the information your employer gave you to see whether you have a health savings account , health reimbursement account or flexible spending account . Then, use the links below to learn more and find important forms and resources. Sum Insured Your sum insured refers to the maximum amount that your insurance provider will pay in a given policy year.

You can choose your sum insured when you purchase your health insurance policy. But, you should remember that the amount you choose will directly impact your premium. Generally, if you renew your health insurance policy on time every year and there's no break in your cover, we will not require you to take a check-up every year. But, we may take a call based on your medical history and your age. A medical check-up is only required in certain circumstances. For the most part, you will be able to purchase your health insurance policy online without worrying about any tests or visits to the doctor.

If we need some more information before issuing your health insurance policy, a tele-underwriter will get in touch with you. In some instances, we may require you to do a few tests before we issue you a policy. To ensure you have the best possible protection, you may want to purchase a few add-ons or riders along with your medical insurance policy. An add-on offers additional cover for a small cost, which is added to your total premium.

Out-of-network/non- contracted providers are under no obligation to treat UnitedHealthcare plan members, except in emergency situations. Please call our customer service number or see your Evidence of Coverage for more information, including the cost- sharing that applies to out-of-network services. The providers available through this application may not necessarily reflect the full extent of UnitedHealthcare's network of contracted providers. There may be providers or certain specialties that are not included in this application that are part of our network. We also recommend that, prior to seeing any physician, including any specialists, you call the physician's office to verify their participation status and availability.

The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. For more information, call UnitedHealthcare Connected® Member Services or read the UnitedHealthcare Connected® Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year. UnitedHealthcare Connected® (Medicare-Medicaid Plan) is a health plan that contracts with both Medicare and Texas Medicaid to provide benefits of both programs to enrollees.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.